Hon. Wole Oke, the chairman of the committee gave the ruling at a public hearing on Tuesday in Abuja.

He said that it was wrong for the FIRS to take part of the money belonging to the FCT-IRS under any guise. The funds represented two per cent of total tax collected in the Federal Capital Territory (FCT).

“Our ruling will be that the chairman of the FRIS should refund the taxes collected due to the FCT-IRS.

“That the chairman, FCT-IRS, if you are still in need of the services of FRIS, due process should be followed and engage FIRS and pay them properly,” he said.

Oke said that by the establishment and commencement of operations by the FCT-IRS, they were entitled to collect five per cent of total tax collection in the territory.

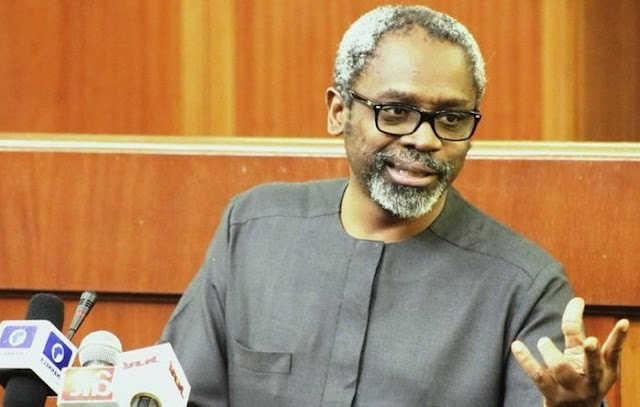

Earlier, the Chairman, FIRS, Mr Tunde Fowler, said that FIRS takes two per cent of total tax collected to cover for the cost services rendered to the FCT-IRS.

He said that 170 FRIS members of staff were on secondment to FCT-IRS and that their salaries and other benefits were being paid by the FIRS.

Fowler said that the FIRS also gave logistics support to the FCT-IRS and that it is housing the agency too.

”We started with four per cent but as at last year, we renegotiated it to two per cent.

“We support other states IRS but for FCT, we have given them building, logistics and staff, even this two per cent is not enough to cover the cost.

“We cannot continue to support them this way, I may be forced to pull out our all my staff and support which will have negative impact on revenue generation in the FCT,” he said.

Meanwhile, the People's Democratic Party (PDP) has urged the Senate not to Pass VAT increase bill which they described as insensitive.

Source| NAN.ng