The criteria for borrowing money from these websites vary and you should read them up before applying, also it'll be important for you to know the charges to avoid applying for something that you can't really carry.

The repayment period given for this loans vary but runs from a period of 14 days to six months.

Below are some of the websites that are currently giving out loans and their criteria for approval.

How To Borrow Money Online Instantly In Nigeria

The websites given below are some of the providers of collateral free loans. Before applying, please honesty should be your key guideline. Remember, they are helping you so their magnanimity shouldn't be an avenue for you to device a means of duping them or scamming their money.Websites That Give Online Loans In Nigeria

- PayLater.ng

All you need to do is to:

- Download their Android mobile app

- Install it to your device

- Fill out a brief application form that will be shown to you after installing it. It is for them to know you better, you know this is Nigeria and money is involved.

- If your application is approved, the loan will be credited to your local bank account in a space of five minutes.

Things you need to know about PayLater.ng

- You must have a valid bank details and BVN to qualify for a loan.- They only give loans to people that have installed their Android apps, that is it is not web-based.

- Their interest rate ranges 15% to 40%, it all depends on the credit rating.

- The loan tenure is from a period of 2 weeks to 6 months.

- You can only get a loan at a time, no multiple loans to a single user.

- Their payment gateways for repayment of loans include direct bank transfer, Debit Card and Quickteller.

- According to PayLater.ng, users that repay loans on time have access to higher credit limits.

- They usually charge

- Presently, Paylater.ng have limited the amount they loan out to first-time applicants to

Finally, if you are caught up in a situation whereby it becomes hard for you to repay the loan at the scheduled time, you can send the an email to [email protected] to avoid complications.

- SnapCredit.ng

They work with employers to provide an easy online platform so their staff can have access to loans.

All you need to do is:

- Create an account if you don't have one already if not sign-in to your account.

- Apply for a loan. You can do so with your mobile devices, tablet or personal computer.

- If your details are verified, the money will be credited to your employees account immediately and you'll get the loan.

- The repayment will be done by your employee on a monthly basis from the money by deducting it from your salary.

Things you need to know about SnapCredit.ng

- You must have a valid bank account to be eligible for a loan and must be an employee of an organisation.

- It works on all devices.

- The loan tenure ranges from a period of 1 month to 12 months.

- You can apply for multiple loans at a time, however you can't borrow an amount greater that your credit limit.

- Repayment is made by your employee, he will be deducting the money monthly from your salary until they are all settled.

- SnapCredit.ng is owned by Snap Credit Ltd Company and it's registration number is RC 1219478.

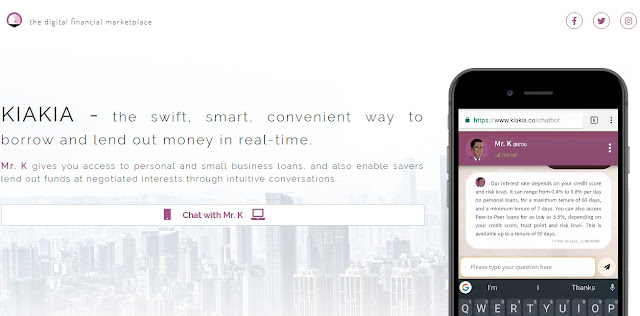

- KiaKia.co

This is another site that offers loans to Nigerians. You can choose to register either as a lender or a borrower, registration to the site is done by a chat-bot called Mr. K, why don't you chat with Mr. K the next time you need a loan?

He'll also take you through any other activities that will enable you get the loan faster.

Things you need to know about KiaKia.co

- You are required to have a valid ID card and a valid Nigerian account details before you can be eligible for loans.

- All platforms are supported.

- You are required to repay your loans within a period of 7 days to 1 month.

- You can register to the site as a lender and earn interests on your money.

- You cannot apply for multiple loans at a time.

- Repayment is via direct deposit or debit cards.

- KiaKia™ is a business owned by KiaKia Bits Ltd with registration number RC N∗ 799552.

- FINT.ng is owned by FINT Technology Africa Limited and its license number is 0000057.

- FINT.ng

This is another site that is similar to KiaKia.co but doesn't work with a chatbot. It allows you to either borrow or lend money. According to them, borrowers can have access to loans that are as low as 2% per month and the borrower’s risk score determines the interest rate.

Things you need to know about FINT.ng

- To be eligible for a loan, you need to show your bank statement, have a valid ID card and also valid bank details.

- All platforms are supported.

- The loan tenure varies from a period of 2-12 months.

- Interest rates range from 9% to 39% but they said that you can borrow for as low as 2% interest rate.

- You are not eligible for multiple loans at a time.

- The repayment methods include direct deposit and debit cards.

- You must have a Tax Identification Number in order to be granted a loan. This signifies that only tax payers are eligible for loans.

- Finally, you will also be required to pay a risk assessment token of ₦3,000.

- Finally, you will also be required to pay a risk assessment token of ₦3,000.

- C24.com.ng

C24.com.ng offers a collateral free loan just like the others bu have a different method of application.

You are required to submit some documents at their physical office or even have them pick up the documents at yours.

Documents to submit include:

- National identity card like the drivers license, personal voters card, etc.

- Proof of employment

- bank statement

- a recent passport photograph and

- post-dated cheques

How to apply for C24.com.ng loans

- Fill the application form online- Submit the required documents at the different outlets

- They'll analyse your application

- You'll receive their call

- You'll wait for 24 hours for the details to be verified

- If approved, the amount will be credited to your account

Things you need to know about C24.com.ng

- You are required to present the documents stated above

- It is web-based and supports all platforms

- Interest rates are 4% and above

- The loan tenure ranges from 1 to 9 months

- You are not eligible to collect more than one loan at a time

- Repayment channels include direct deposit and debit card.

- You must have been employed for a minimum period of six months to be eligible for loans

- You must be above 22 years old

- Have a good credit history

- Have a functional bank account

- Zedvance.com

Just like the C24.com.ng this also requires submitting some documents but this time around you'll be required to upload it and not visit their physical office.

Things you need to know about Zedvance.com

- You are required to present some valid bank details

- It is web-based and all platforms are supported

- Interest rates vary from 7.8% to 58% depending on the amount

- Loan tenure is from a period on 1 to 12 months

- You are not eligible for multiple loans at a time

- Repayment methods include direct deposit, direct debit and cheques.

- You must be in a paid employment

- You must have an active salary account

- Your age should be between 22 and 55 years for the loan to be approved

- You must have a pension account

- PayConnect.ng

To be eligible for PayConnect.ng loans, you must be an employed Nigerian citizen and worked for a minimum of 6 months. You'll also need to present your employee's approval and a bank statement of the last three months prior to the time of the application.

How to apply for PayConnect.ng loans

- Request access for their mobile App

- Your loan request will be received and approved

- The amount will be deposited into your PayConnect Loan e-wallet and you can transfer it to any local bank account, withdraw it from any ATM or use it at any POS around.

- The loan repayment will be automatically deducted from the source account on the repayment due date.

Things you need to know about PayConnect.ng

- You need to present a staff ID, Government approved ID card and have a salary account with a Nigerian commercial bank to be eligible for a loan.

- Presently, you must have their Android app to be able to use the services.

- The interest rate is from 28% to 31%.

- The loan tenure is for only a month.

- You are not eligible for multiple loans.

- Repayment is by direct debit.

- FairMoney.com.ng

FairMoney.com.ng requires that you upload a selfie of yourself holding an ID card. This is a measure against fraud. You'll also be required to give some details of your next of kin.

How to apply for FairMoney.com.ng loans

- You are required to download their mobile app from Google playstore.

- You'll be asked some questions, if you are selected you'll receive the loan in a short time.

Things you need to know about FairMoney.com.ng

- You are required to present your Facebook account, proof of employment and real bank account details.

- Presently, they only support Android users. You can download their Android app to use the service.

- The interest rate ranges from 20% to 30%.

- The loan tenure is for only a period of one month.

- You are not eligible for multiple loans.

- Repayment is by direct debit.

- Salary earners can borrow loans reaching N40,000 on their first deals while it's a maximum of N20,000 for the self-employed.

- Branch.co

This site requires your Bank Verification Number, Facebook account and a valid account details for your loan to be approved.

Some information from your phone will be required also like your SMS logs, call logs, handset details and contact list.

How to apply for Branch.co loans

- Submit your application form.

- If approved, you'll receive the loan.

- Early repayment will also unlock larger loans.

Things you need to know about Branch.co

- You are required to present your Bank Verification Number, Facebook account and valid bank details.

- Presently, you must download their Android App to be eligible to use the system.

- Their interest rate is 20%.

- The loan tenure is for one month.

- You are not eligible for multiple loans at a time.

- Repayment channels include auto-debit, debit card and mobile banking app.

- CreditDirect.ng

CreditDirect.ng offers loans to both entrepreneurs and salary earners. You are required to present a means of identification, post dated cheques, a recent passport photograph, bank statement, direct debit mandate, and a guarantor to get a loan.

How to apply for Branch.co loans

- Visit the application page.

- Fill in your loan details, Customer details and employment details.

- Wait for approval

- If approved, the loan will be credited to your account.

Things you need to know about CreditDirect.ng

- You are required to present some physical documents, personal bank details and a Guarantor.

- All platforms are supported.

- Their interest rate is 5% for a month and up to 59.99% for twelve months.

- The loan tenure is for a month plus.

- You are not eligible for multiple loans at a time.

- Repayment channels is direct debit.

These are some of the sites that offer loans to Nigerian business starters and other people.

You can also check out these sites:

- Loanboy.co.uk: For people living in the United Kingdom.

- Kiva.org: This offers three different kinds of loans, students' loans, personal loans, and business loans and it is based in the United States.

- USDA loan map: For individuals residing in the United States of America.

- BankRate.com: They offer loans in three different categories, the personal loans, the business loans and then student loans.

- LoanPioneer.com: It only offers loans to U.S citizens and you must be 18 years and above to be eligible.